The COVID-19 pandemic has led to an acceleration of what was already on the cards as far as brand owners are concerned: the need to change the way in which physical brand intelligence-gathering at point of sale is carried out.

These days, most of the buzz around brand surveillance at retail level tends to hover around online sales sites as opposed to 'brick and mortar' outlets, mainly because of an acceleration in the shift towards online shopping, triggered by the pandemic.

According to a US Department of Commerce report, e-commerce sales in the US increased by 14.2 per cent in 2021 compared to 2020, and by 50.5 per cent in 2020 versus 2019. However, one should also bear in mind that e-commerce still only represents 13 per cent of all US retail sales.

So, while e-commerce is clearly on an upward trajectory, more than 80 per cent of retail sales still take place at physical 'high-street' locations, at least as far as the US is concerned. Which means that 'boots' are still very much needed on the ground to monitor brick and mortar points of sale, in addition to e-commerce sites.

Brand owners don't have 'boots'

Given that brand owners do not employ armies of investigative personnel to walk the streets on their behalf, there is a clear need for third-party providers to step in to assist brand owners, in the form of market surveillance and product intelligence services that help brands quickly identify and act upon cases of infringement before it is too late.

One company offering such a service is ApiraSol GmbH, which was founded in Germany in 2010 with support from the German private sector.

The company describes itself as the 'investigative approach to brand protection', and the 'missing link between online monitoring and physical investigations'. It also claims to have probably the world's largest network of detectives, many of whom possess extensive anti-counterfeiting experience.

Essentially, ApiraSol offers market surveillance services that encompass both online and physical sales sites, as well as a service combining online intelligence with shipment analytics in order to uncover entire illicit supply chains.

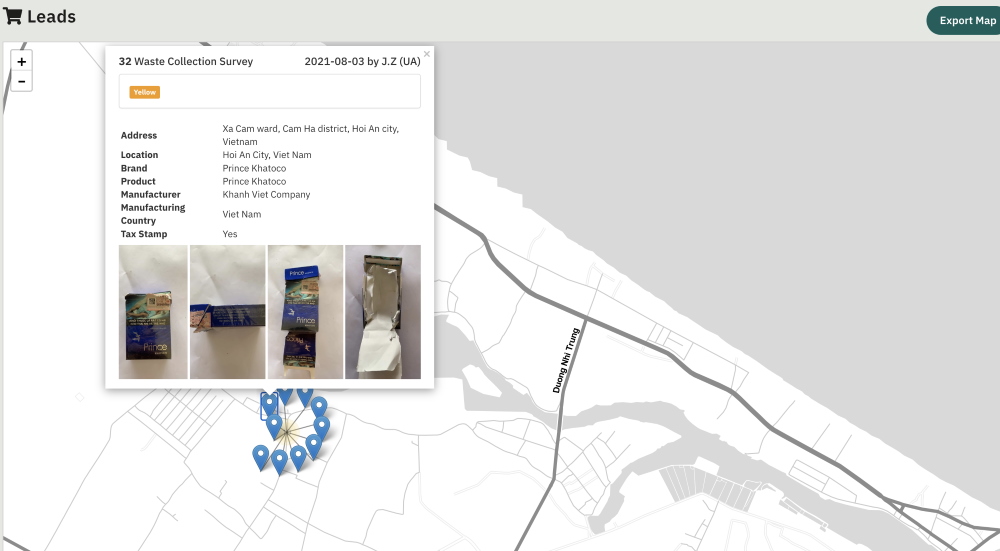

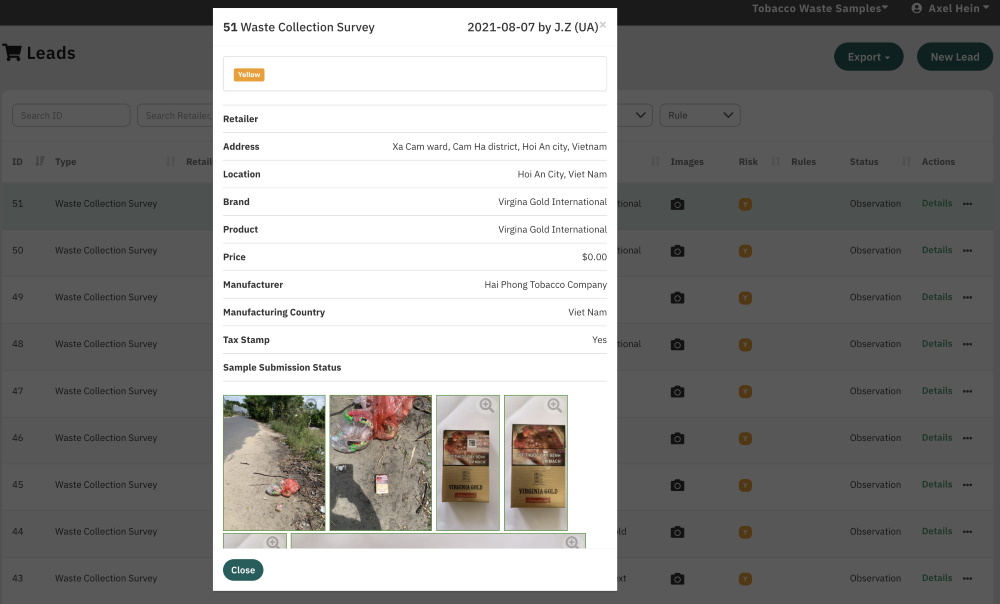

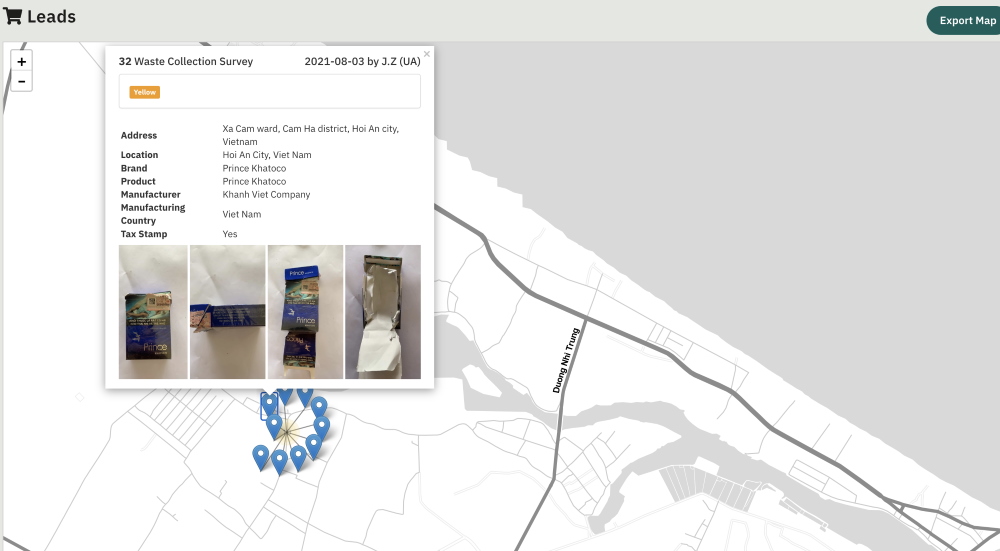

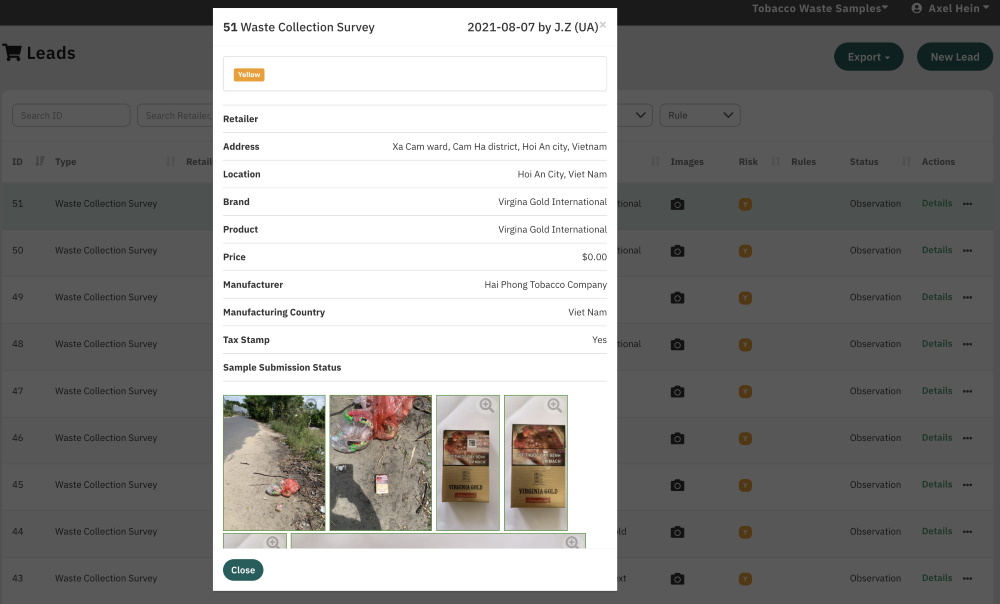

In terms of physical surveillance at market level, the ApiraSol POSINT (Point of Sale Intelligence) Suite, is an offline monitoring service that captures product intelligence directly at the point of sale – sometimes through undercover inspections. In this regard, ApiraSol works with more than 1,000 partner detectives who visit shops and capture intelligence in over 160 countries – from Albania, to Guatemala, to Nepal, to Zimbabwe – so practically the entire globe.

The intelligence includes information on physical indicators on the product, including expiry dates, batch codes and third-party security features such as holographic devices. It also includes information on the names and locations of retailers visited.

The intelligence is instantly shared with brand managers and product security teams via a single POSINT interface. The detectives also capture high-quality product images at points of sale or through waste collection, thereby avoiding the physical handling of samples and, consequently, reducing investigation costs.

The main goals of the investigations are to:

- Identify counterfeits

- Monitor the physical appearance of products and identify instances of tampering

- Uncover activities related to parallel trade and product diversion

- Monitor the presence of recalled products.

Reducing physical samples

ApiraSol POSINT also addresses another lifestyle trend facing brand owners, apart from the surge in online shopping, which is the shift towards working from home.

Traditionally, brand protection managers used to monitor what was going on in the market by ordering huge quantities of test purchases, which were delivered to their office, took up a vast amount of valuable space, and proved very difficult to manage physically.

There was also the issue of some of these purchases being stripped and damaged during customs inspections, thereby rendering them unfit for subsequent examination by brand managers. And if we combine this issue with the additional risk of some physical properties of samples being prone to alteration during long journeys, the end result was a lot of lost time, money and effort.

While the traditional practice of receiving massive amounts of sample products was already proving sub-optimal for brand owners, the shift to working from home as a result of the pandemic has made this practice even more unsustainable.

With the COVID-19 pandemic, remote work has become a standard practice. More and more brand protection and product security teams will choose, whenever possible, to avoid receiving product samples at their HQ offices. It is convenient to access product intelligence via a web interface and while working from home. This approach avoids having to store samples and go to the company offices to check them.

Instead, brand managers now prefer to work with high-quality images of all parts of a product, which they need to be able to access quickly, while the product is still in the country where the intelligence was gathered. Then, with this digital intelligence in hand, managers can decide whether the physical sample can be destroyed or whether it should, rather, be shipped to their office.

The idea behind this service is that good images and additional POS intelligence can help to decrease the number of physical samples needed to be shipped to the brand manager.

Single interface

Another key benefit of POSINT is that brand managers only have to deal with a single interface which collects standardised data from multiple detectives, rather than having to deal with individual detectives with their different ways of reporting and taking photos, and their unstructured data. This not only saves time in communication, but also allows brand managers, and ApiraSol itself, to work with easily searchable, structured data that can be aggregated and compared across many countries.

Furthermore, product intelligence, delivered via a single interface, reduces investigation times, as the client does not need to wait for a sample to travel to another country. Instead, clients can access product intelligence right after the product has been identified in the market.

Having structured data on product samples allows for the generation of global reports that would have otherwise been impossible to create with unstructured data. Such reports could include, for example, statistics on the most common physical indicators detected on counterfeit products, such as serial numbers that are repeated across multiple products when they should in fact be unique to each one.

Working with POSINT therefore means having access to a standard for sample evidence, including images, batch codes, packaging descriptions, prices, receipts, POS websites, shop fronts, shelves, and expiry date and lot code analyses.

Case in point

In a recent study, ApiraSol gathered cigarette box samples from the streets in Ukraine, Bangladesh and Vietnam.

The product intelligence collected included brand names, geolocation and multiple images, including images of tax stamps, when available. In particular, the study looked at how the presence (or absence) of tax stamps varied between different cigarette brands in different cities.

Waste collection survey in Vietnam (source: ApiraSol).

The structured nature of the intelligence gathered from the study allowed for the generation of statistics that provided answers to key questions such as:

- What cigarette brands, in which countries, are more likely to be missing a tax stamp?

- What illicit producers are associated with product samples that lack tax stamps?

- What countries and products are carrying tax stamps that are counterfeit or have been tampered with?

Quickly identifying cigarette samples without tax stamps gives an early warning sign to enforcement authorities, providing them with specific intelligence such as geolocation, related products and images of fraudulent tax stamps.

Illicit trade is surging

In closing, let's consider another alarming trend that has been exacerbated by the pandemic: the surge in cases of illicit trade around the world. This was brought on by a combination of supply chain disruptions that made legitimate goods more difficult to obtain, economic hardship that caused more people to turn to cheaper illicit goods, and e-commerce sites that facilitated access to such goods... among other reasons.

In light of these developments, market surveillance and brand intelligence activities are becoming an even more essential element of a brand protection strategy, together with the right technologies and systems to support the surveillance process.

Brand owners, customs officials and government inspectors can only do so much to quell the rising tide that is illicit trade. Therefore, going forward, service providers such as ApiraSol will likely have increasingly larger roles to play in the global fight to protect intellectual property and secure legitimate markets.

Main image by bernswaelz via Pixabay

Axel Hein

Managing Director, ApiraSol GmbH

Axel is widely recognized as an expert in Brand Protection, Supply Chain Intelligence and Investigations. He has a background in diverse disciplines, including six sigma and innovation consulting.

Since 2010, he has been engaged in Brand Protection, co-founding and managing ApiraSol GmbH in Germany.

Axel has contributed to the fight against counterfeits with game-changing technical innovations. Axel has a Master’s degree in International Business Consulting, with a focus on Supply Chain Management.

©

SecuringIndustry.com